1.4 Billion Worldwide Gamers Comprise an $80 Billion Games Industry

Posted on February 13, 2014

We recently connected with DFC Intelligence to talk about their latest gaming industry brief, a document plotting trends in the gaming industry across all platforms. DFC retains a lot of its deeper analytical information as part of their analysis tool (useful for industry analysts and game publishers), but releases a spoiler each year that gives a summary of core statistics.

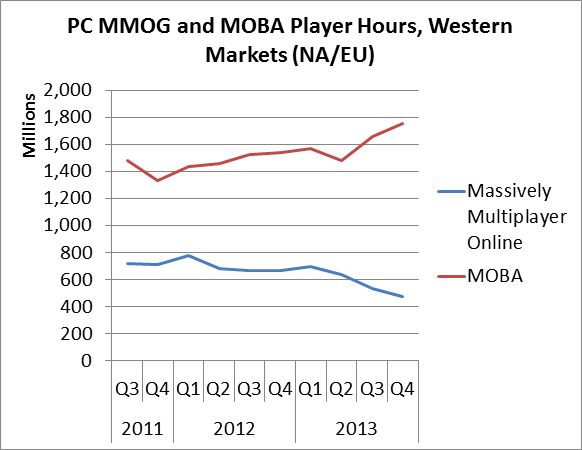

After reaching out, we were able to obtain some relative statistics for MMOs, MOBAs, FPS games, and RTS games; some of the stats provided were relative to each other and we were encouraged not to share specific numbers due to the nature of the collection process, but you can glean an idea from the charts below.

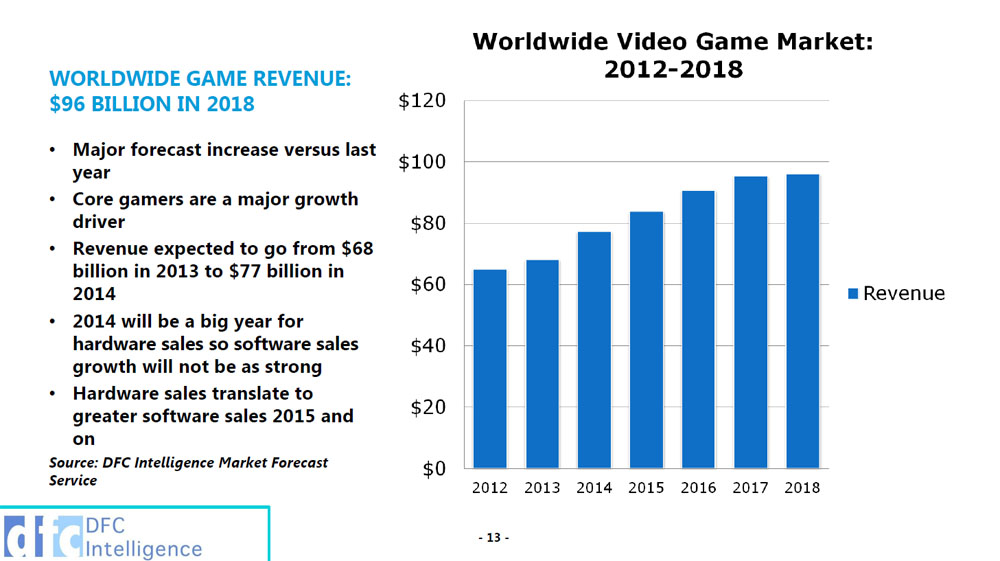

Most noteworthy, though, is that the global gaming industry's revenue is marked at nearly $80 billion, with global gamers counting at 1.4 billion; if we exclude the casual games market, we're still left with 270 million "core gamers," as defined below.

Our previous article on this topic can be found here, which discusses the decline of MMOs as MOBAs have risen.

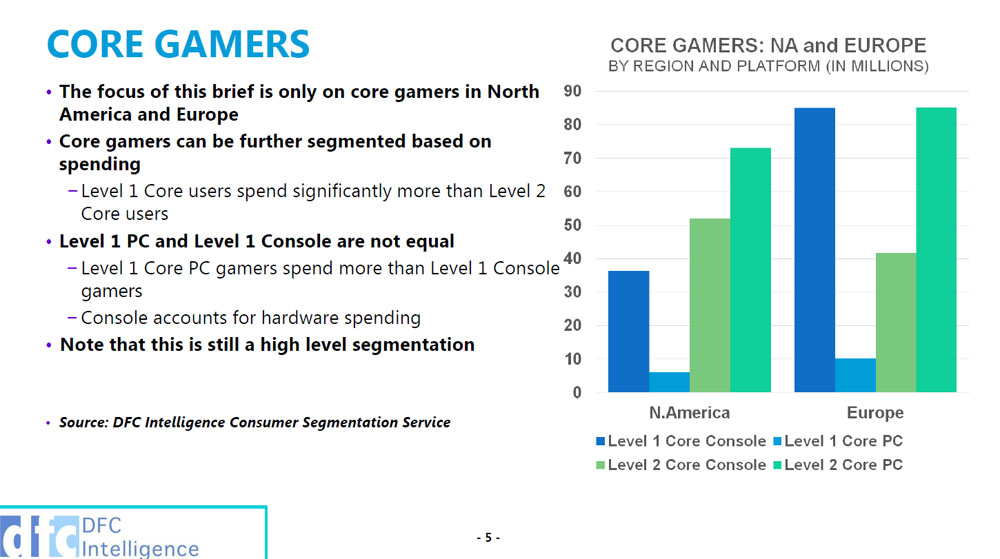

First, let's define DFC's terminology. DFC uses the phrase "core gamer" throughout their briefing, stating that all of the statistics within are representative strictly of "core gamers." Some of the images below also reference "level 1" and "level 2" users. When asked what all that meant, we were told the following:

"A Core Gamer is someone that spends a significant amount of money on games that have a large client and require fairly expensive hardware such as a dedicated game console or a PC. There is another category for High-spending, low end users which would be those that play browser/social network type games, even though they spend a lot of money. The core gamers can be split into multiple levels:

- Level 1 users are those that spend a lot on their game hobby ($1,000 or more a year for PC, $500 for console).

- Level 2 users are those that spend $50 or more."

That defined, we can move to some of the information revealed.

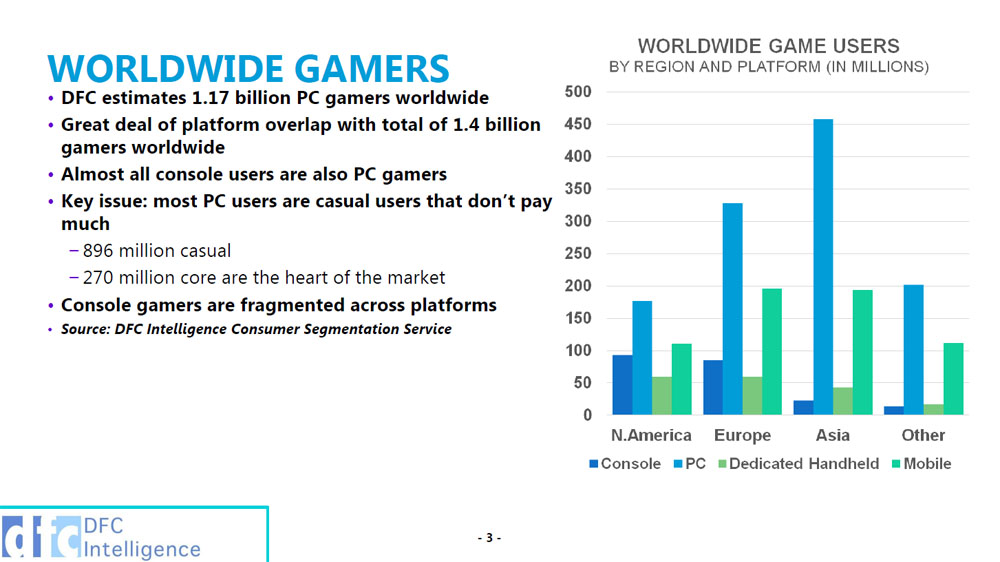

DFC Intelligence reports that there are 1.17 billion PC gamers worldwide with a total of 1.4 billion total gamers worldwide (platform overlap). The vast majority of these 'PC gamers' are of the casual variety, though, and would probably not be considered "gamers" by our own audience. Regardless, it's a big number and shows that gaming is widely accepted.

The study then notes that there are 270 million "core gamers" at the heart of the market (those who dedicate a good deal of money to gaming each year). Unsurprisingly, the count of total gamers swings toward PC when including the casual market, but swings back rather pendulously toward console gamers when only counting "core gamers" (or traditional gamers - those who actually identify as a 'gamer' and contribute monetarily to the industry).

Leading up to this study, there have been concerns in the game industry about predictions in declining interest; those predictions, thankfully, did not take hold, but were not unfounded. With the undisputed failure of the Wii U at launch and the painfully long platform life of the last-generation consoles, Nintendo served as an indicator early in the year that there'd be a decline. Further adoption of mobile gaming and dominance of free-to-play titles also suggested the first slow-growth (or even decline) in a number of years, at least monetarily. Moreover, AAA titles were lacking in 2013 and PS4/Xbox One launch titles were limited (with the flagship titles not launching until 2014 - like Titanfall).

At the end of the year, though, things were looking up:

- "Hardcore" PC gamers who spent more than $1000 in a year nearly doubled, reaching approximately 10 million total users (up from ~6m in the previous year).

- PC gamers who spent $50 or more were counted at roughly 85 million (up from ~72m the previous year).

- Console gamers who spent $500 or more (including hardware) numbered approximately 84 million (up from ~37m the previous year)).

- Console gamers who spent $50 or more numbered about 41 million (down from ~50m the previous year - many of these users migrated to the '$500 or more' category due to launches).

Other Noteworthy Trends & Genre Popularity

PC game usage was flat (minimal growth in annual hours played) in 2013 over 2012, with most of our biggest, audience-drawing titles having released toward the end of 2012. One of the biggest releases for PC in 2013 was Battlefield 4, and even that had marginal pull compared against the monstrous lineup of 2012.

MOBAs now account for roughly 1.8 billion hours of gameplay (annually); MMOs have fallen to 400 million hours from nearly 800 million in 2012. FPS and RTS games don't have specific hour counts tied to them that we can share, but we know that there was growth for FPS in 2013 over 2012 and decline for RTS in 2013 over 2012. The latter is likely due to StarCraft II's age, which is the only noteworthy RTS currently on the Western market; meanwhile, FPS growth can be attributed to the continued success of CSGO, the launch of Battlefield 4, and the continuation of the Call of Duty franchise. Traditional RPG metrics were not available at this time.

DFC Intelligence noted that while there was significant growth in PC and console 'core gaming' audiences, traditional handheld gaming has been harshly penalized by the ubiquity of mobile phone gaming. DFC also called tablets a 'luxury' gaming item, noting that they are desirable to some market segments, but not necessarily readily accessible.

Free-to-Play is still on the rise globally, but DFC notes that consumers are in large part willing to pay upfront "for the right game." DFC also said that hybrid business models -- like the one CSGO has taken, where the game retails at ~$15 but also has an aesthetics-only storefront -- have shown promise in the industry.

The report made a statement that agreed with our PS4 analysis article, wherein I claimed that the x86 platform and new generation of consoles would further enable PC gaming; the group said: "The launch of new console systems is a positive for the core PC game market. Developers are releasing AAA titles for console and PC, including Titanfall, Project Spark, ESO, Daylight, and others."

Game Industry Revenue, Sales, & Other Business

The research firm estimated the Xbox One's total 2013 sales at 2.8 million, noting that "despite [DRM and other] concerns, it's already off to a much bigger launch vs. the Xbox 360." They also call Titanfall a "huge game to watch," as it is the first major title of this generation.

The Playstation 4 was estimated at 4.2 million sales, though the firm marks that it will not launch in

DFC estimates both consoles to surpass 100 million lifetime unit sales, which would be the first time within any console generation that competing units surpass 100 million sales. The Wii is the only previous console to achieve similar numbers.

Finally, annual revenue & revenue predictions for global gaming (PC, console, & mobile) can be found above. We're expected to hit nearly $80 billion in global revenue this year (other reports have predicted $101B, depending on their age and who ran them); in 2013, the industry's revenue was marked at $68 billion. DFC says that hardware sales will be significantly higher in 2014 due to new platform launches, so it is likely that software sales will see a spike in 2015 (pushing us past $80 billion) as a result. The PC games market is estimated at $26 billion for 2014.

If you have any questions, be sure to leave them below and we'll do our best to get them answered.

You can read more about DFC over here: http://www.dfcint.com/index.php

- Steve "Lelldorianx" Burke.